"Pandemic QE" and its aftermath

Inflation is the number one concern among voters, and that's a big problem for politicians and the Fed.

Last August, HardmoneyJim reported consumer prices rose at the fastest annual rate in 40 years. Since then, there has been no slowing in price increases and no sign inflation has peaked.

While some Wall Street investors (Cathie Wood, for example) downplay inflation’s importance, not us. Inflation's economic and political consequences will likely be harsh because neither the Fed nor the Administration can slow rising prices in time to stop a citizens’ revolt.

Former Federal Reserve Chair Ben Bernanke sowed the seeds of the current crisis in November 2010 when he announced a new economic stimulus called Quantitative Easing. Since then, “QE” has been the Fed’s primary monetary policy tool.

QE is Fedspeak for purchasing large quantities of Treasury bonds and mortgage-backed securities with new, made-up money. It’s a multi-step procedure performed in an instant. First, the Fed directs a commercial bank to buy a Treasury or mortgage-backed bond from a private investor. The bank pays for the bond by making a ledger entry (a “deposit”) in the investor’s account. By this act, the bank creates new money for the investor to spend. Simultaneously, the Fed buys the bond from the bank by creating a new “deposit” in the bank’s account at the Fed, increasing its bank reserves. (Bank reserves are a special kind of money used mainly to settle transactions between banks.)

Banks and the Fed create these new deposits and reserves with mere computer entries. Think of it as “mouse-click money.”

QE practiced on a large scale for over a decade achieved the following monetary outcomes:

1) Handed investors hundreds of billions of dollars of new money, held as commercial bank deposits, to spend in the investment markets.

2) Handed commercial banks hundreds of billions in new cash reserves on deposit at the Fed.

3) Bid up the price of bonds, causing the prices of other assets like stocks and real estate to rise as well.

4) Drove down interest rates, encouraging excessive borrowing and speculative investment.

5) Unjustly increased the wealth gap between the rich and almost everyone else.

From 2009 to the end of 2019, the Fed reacted to any modest market downturn with more QE, more asset purchases, higher asset prices, and lower interest rates. The rich got richer as stocks soared by an average of over 13% per year. Meanwhile, those who were paid in dollars (most people) lost about 2% per year on purchasing power. As long as QE did not cause enough consumer price inflation to ignite a protest, the Fed believed it could continue pumping money and inflating asset prices while lowering interest rates.

But in 2020, the COVID bug bit, breaking the shell of this fragile prosperity. Government lockdowns, mandates, and poor public health decisions crashed the economy. In response to tumbling asset prices and soaring unemployment, the Fed joined the Treasury and Congress to unleash “QE of the Pandemic.” This tidal wave, seen on the right side of the graph below, added $6.3 Trillion to the money supply in only two years.

QE OF THE PANDEMIC: M2 money supply

Pandemic QE was different from its monetary predecessors not only in quantity but also in direction. Due to a rising flood of money chasing limited goods, consumer prices shot through the roof. Unlike previous QE programs, these super-sized asset purchases sent cash not only to Wall Street bankers and traders but to Main Street businesses as well as their employees and customers. Just about everyone got Covid Bucks. What happened next? Consumer prices rocketed skyward.

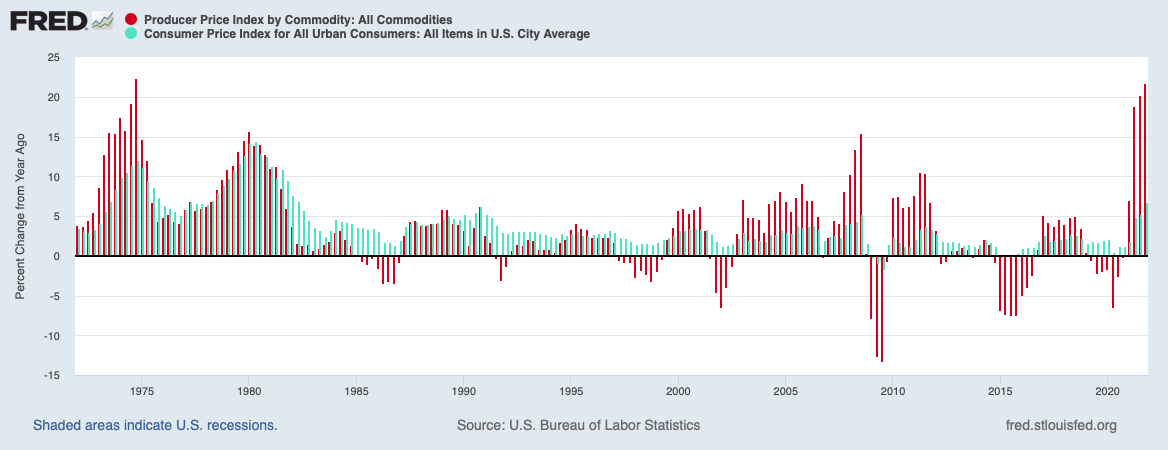

Only six months ago, Fed Chair Jerome Powell still stubbornly claimed rising consumer price inflation was “transitory,” but the data since then confirms continuing upward price momentum. In January, the All Commodity Producer Price Index posted a year-to-year increase of 22%, a rate not seen since 1974.

In another signal of entrenched price pressure, Goldman Sachs reports soaring commodity prices, with the Bloomberg Commodity Spot Index having almost doubled in the last 24 months. Like producer prices, rising commodity prices will eventually pass through to consumer goods. “This is the most extreme inventory environment,” said analyst Nicholas Snowdon, “It’s a completely unprecedented episode. There is no supply response.”

As these background data corroborate inflation’s persistence, it’s also becoming clear that the latest annual CPI increase of 7.5%, the highest in 40 years, callously understates the financial burden on working citizens with scant savings and minimal assets.

Those who live paycheck to paycheck spend most of their income on essentials like shelter, fuel, and food, all of which are rising at double-digit rates. HardmoneyJim has already documented double-digit increases in shelter costs. In many places, the price of a gallon of gas has been up 50% over the last two years. And, contrary to the CPI number, rising food costs are not a 7.5 percent problem but a double-digit nightmare.

(Bloomberg, BLS data)

In a recent conference call, Jim Bianco of Bianco Research * put the inflation problem this way:

“Inflation is the number one concern among voters. It is not COVID, it is not climate change, it is not the southern border, it is not Ukraine. For the first time in over forty years, the number one concern is inflation, and it is a big problem for politicians and for the Fed.”

Consumer price inflation hurts everyone, but it’s a very different experience depending on your wealth. If you own assets, like a home or stocks, your net asset value (value of assets less value of debt) has risen substantially since the start of the Pandemic. Since March 2020, the median sales price of a house is up 29%, while the S&P500 stock index is up 70%. You may be irritated by food price inflation, but asset appreciation of that magnitude sure cushions the blow.

Not everyone is so lucky. According to Bankrate.com, nearly 40% of Americans say they cannot cover an emergency expense of $1000. Unless your wages rise along with consumer prices (and as of now, this is not happening), you are immediately in big trouble when prices rise 10% or more. If your only money is a small paycheck, all that matters is how much it can buy.

(reprinted with permission)

It’s not hard to see why inflation triggers anger in voters and fear in elected politicians. Some of us can recall the persistent double-digit inflation of the 1970s, when the combined effects of economic stagnation and rising prices gave rise to a new term, “stagflation” - a social condition marked by stagnant growth, rising consumer prices, a bear market in stocks, rising interest rates, price controls, a high crime rate, and social unrest. Like an old movie, that stew of problems could be making a comeback.

High consumer price inflation, unseen for decades, is a political emergency that demands drastic political action. What will those actions be?

So far, the Biden Administration has offered token responses, like a “holiday” on federal gasoline taxes and some predictable complaints about corporate greed. Such talk is reminiscent of the 1970s “WIN” (“Whip Inflation Now”) program, viewed as a national joke at the time.

For the time being, Biden seems satisfied to blame the Fed for inflation and let the Fed lead the fight. “The critical job of ensuring the elevated prices don’t become entrenched rests with the Federal Reserve, which has a dual mandate: full employment and stable prices,” said Biden in a January 19 speech. In other words, Joe Biden has tossed the inflation problem squarely into Jay Powell’s lap. One can almost hear Powell whisper, “C’mon, man!”

So if Powell fails, it is he who will take the fall. In that event, the Administration can ride to the rescue with its solutions, including price controls, which always cause more significant economic problems. But for now, inflation is the Fed’s problem.

Powell has already committed to scaling back QE and will announce an increase in short-term interest rates on March 15. As that date approaches, many talking heads think the biggest risk to markets is that the Fed will make a “policy error” by choosing to be either “too loose” or “too tight.”

Simplified, this view of Powell’s predicament is: does he continue supporting the stock market by printing money, which also fuels consumer inflation; or does he slow the flow of money to Wall Street, which would dampen economic demand and reign in consumer prices, but not so much that he kills the stock market and the economy? This view of his dilemma assumes a delicate balance between pro-Wall Street and pro-Main Street policies, some middle ground, that would maintain high asset prices and low unemployment while simultaneously dampening consumer price inflation.

But is the “middle ground” premise valid? Rabobank’s resident Fed-watcher, Philip Marey, casts doubt:

“Policy rates are at the zero bound and the Fed is still buying assets [at $60 billion per month-ed.] when GDP growth is 6.9%, CPI inflation is 7.5% and unemployment is 4.0%. Is this rational monetary policy or are the lunatics running the asylum?” … All Fed choices are bad. There is no oasis ahead, as markets like to believe. There is no Fed ‘masterplan’ to stop inflation without stopping either the asset-price appreciation we’ve built markets on for decades or the faux appreciation for the working class we’ve built markets on the backs of for decades, or both.”

(quoted from the King Report, Feb 17, 2022, italics added.)

We agree with Marey, because we think Powell has already committed a policy error too big to fix. His policies have caused extreme economic distortion that he cannot undo without severe pain. Powell’s irretrievable mistake inflated the money supply by $6.3 Trillion (up 40%) in only two years. Somehow he thought pouring hundreds of billions into workers’ and businesses’ pockets would not inflate consumer prices. Come on, man!

Given inflation’s high impact on voters, our guess (and it’s only that) is that Powell will try aggressively to stifle inflation in hopes he can avoid Administration-imposed price controls. But action aggressive enough to quell consumer prices also risks crashing the stock market, increasing unemployment, and ushering in a recession. In that case, Powell (or his successor) will be under pressure to resume monetary stimulus once again.

More QE, anyone?

Postscript: At HardmoneyJim, we aim to understand money creation and its consequences. For investors, understanding modern money creation is an essential first step in learning to guard your wealth against currency debasement and market manipulation. Voters should realize that money creation has become the government’s most potent political tool. The power to create money by decree is to rule by force.

*subscription required

HardmoneyJim No. 12

It's hard to put an upper limit on the money supply when a keyboard in the input ... rather than a shovel and a pan.

Pretty grim.